Interest only car finance calculator

Fixed Deposit or FD also known as a term deposit in banking parlance is a safe investment option to strike the right balance in ones financial portfolio. For regulated agreements this is normally an exit fee equal to around just 58 days interest charge.

Auto Loan Calculator Calculate Car Loan Payments

Please note that these calculations are only estimates and must be confirmed with your finance provider.

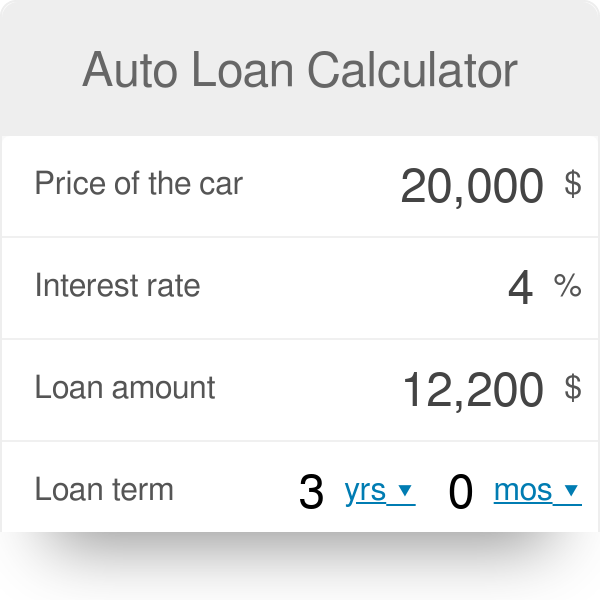

. FD Calculator is a tool that helps in finding the right balance in terms of how much to invest in FD and for how long. The cost of car finance is typically defined as the amount of money you borrow plus the interest and any other charges that youll need to pay on the loan over the repayment term. The price of the car.

Note here that in case you make a deposit in a bank eg put money in your saving account from a financial perspective it means that you. Or even a credit card for that matter the amount you pay back each month reflects principal and interest payments applied toward the cost of purchases. In the next compound period interest is calculated on the total of the principal plus the previously-accumulated interest.

This is the final payment due if you want to keep the car. Interest rates are influenced by the age of the car your credit history as well as various other factors. You can use our Fixed Deposit Monthly Interest calculator to calculate monthly interest you receive based on Deposit amount Rate of interest and Deposit period.

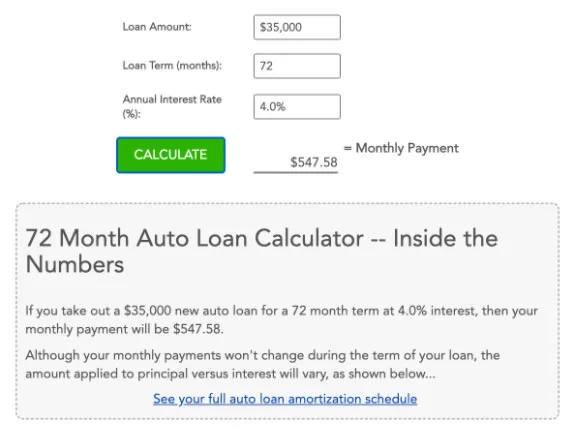

This calculator will also tell you how much you may pay in total over the life of your loan. While our formula computes the future value finding the interest portion is only one more step. Its our predicted future value of the car at the end of the finance agreement and only applies to Flex Car Plan PCP.

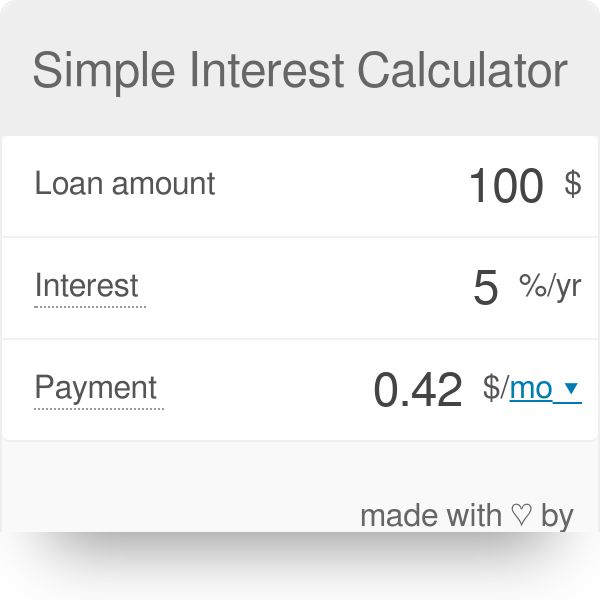

The interest in this scheme is usually paid at a discounted rate for monthly payout fixed deposits. An interest-only loan is simply a loan where the borrower is obligated to pay only the interest on the loan for a certain period of time whether that be for a portion of the loan period or the entire loan period with the obligation to pay back the principal of the loan at the end of loan period. It is the basis of everything from a personal savings plan to the long term growth of the stock market.

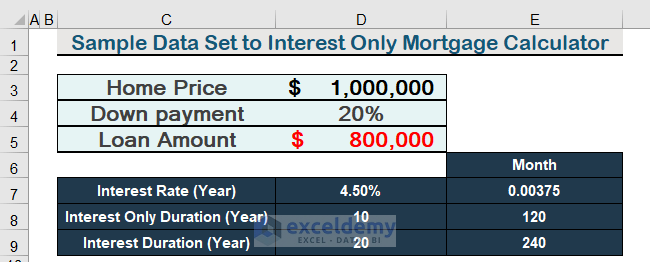

The interest rate applicable will need to be confirmed with your finance provider on application. To calculate your future value multiply your initial balance by one plus the annual interest rate raised to the power of the number of compound periods. Updated 3 September 2022 Our Interest-Only Mortgage Calculator Makes The Numbers Clear Our calculator shows you what an interest-only mortgages repayments will be weekly fortnightly and monthly and reveals the total costs of an interest-only mortgage.

Leasing offers an elegant short-term solution to 0 APR car finance. Our guide to interest-only mortgages explains the pros and cons of such an arrangement in. You only need a car for three years.

You can either pay the optional lump sum to own the car or hand the car back return conditions apply. Only take out car finance if you can comfortably afford the monthly repayments. To get an exact APR youll need to get a car.

If you choose Hire Purchase HP car finance your monthly repayments will cover a portion of the car finance and your interest payment. The options youve selected will result in the interest being higher than the amount youre able to borrow. The three APRs shown by our calculator will only be representative examples.

The interest earned from daily compounding will therefore be higher than monthly quarterly or yearly compounding because of the. Subtract the initial balance. If you dont want the hassle of having.

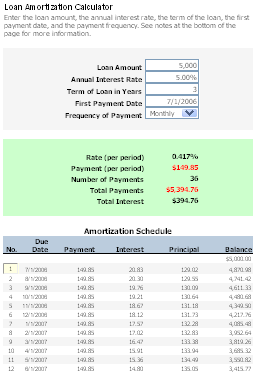

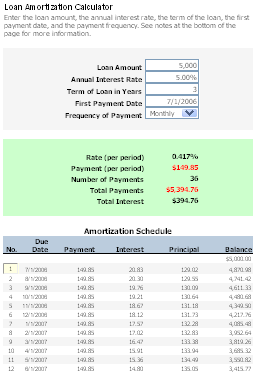

The above calculator provides monthly payment estimates for any type of financing breaking payments down into their essential components. How much deposit you pay. The more frequently that interest is calculated and credited the quicker your account grows.

Use our car loan calculator as a general guide on what your car loan repayments will look like. If you repay the mortgage on. Interest-only Loan Payment Calculator.

Let us know in detail about the features and benefits of using a fixed deposit calculator. In finance interest rate is defined as the amount that is charged by a lender to a borrower for the use of assetsThus we can say that for the borrower the interest rate is the cost of debt and for the lender it is the rate of return. How to refinance your car loan in 7 steps.

These amounts reflect the amount which would need to be paid in order to maintain a constant principal balance. To use this calculator simply enter your estimated vehicle value loan term any initial deposit and the amount of any balloon payment a lump sum payment. The graph displays the periodic repayments for an interest-only loan and the repayments for a comparable principal and interest loan with the same amount borrowed interest rate repayment frequency and fees as the interest-only loan.

Our car finance calculator will show your likely repayments based on a low moderate and high APR. In this case our total accumulated interest is 21665 once again this is the sum of interest earned each year. Duration of the FD monthly income scheme can be up to 10 years.

Halal car finance technically offers interest free cars. All we have to do is subtract our present value from our future value because the future value is simply the present value plus interest. The interest rate that you.

Our settlement figure calculator does not include any additional penalty charges that may be incurred. Lets say you borrow 200000 on an interest-only basis over 25 years at an interest rate of 3. The main advantage of paying a mortgage on an interest-only basis is that your monthly payments will be much cheaper.

The interest rate you are offered. This calculator will compute an interest-only loans accumulated interest at various durations throughout the year. To find out more view our product comparison page.

If you have a car or home loan. The cost of your car finance will depend on lots of factors including. SOURCE FINANCE ESTIMATES IN SECONDS.

It is important to know what you will pay back before you agree to car finance. This calculator is not intended to be your sole source of information when making a financial decision. Applicable interest rates and repayment terms available under a finance contract may vary from the options shown.

Its especially useful if you dont want to own the car dont want to keep a car for a long time or dont have a strong enough credit score to be accepted for 0 APR finance. New Car Good Credit. But there are some pretty big caveats.

Auto Loan Interest Calculator. To be clear this method isnt necessarily cheaper than buying used but it is a bit more convenient. An early settlement figure is the amount still owed plus interest and charges if you want to pay off your car finance early.

Enter the total amount for your equipment finance loan. The length of the term. Finance A Car The Smart Way.

They are general in nature and do not take into consideration your particular objectives financial situation or eligibility for finance. This may be the purchase price only or the purchase price plus an additional amount for costs associated with the purchase including delivery of the equipment installation and commissioning and other expenditure items. Used Car Bad Credit.

The average auto loan rate for a new car was 407 in the first quarter of 2022 while the typical used-car loan carried an interest rate of 862 according to Experians State of the Automotive. Compound interest - meaning that the interest you earn each year is added to your principal so that the balance doesnt merely grow it grows at an increasing rate - is one of the most useful concepts in finance. Compound interest is calculated using the compound interest formula.

For a quote or to apply for finance please contact your Kia dealer.

Free Balloon Loan Calculator For Excel Balloon Mortgage Payment

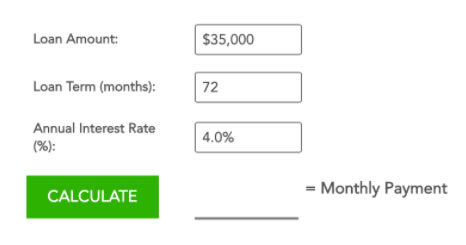

72 Month Auto Loan Calculator Investinganswers

Simple Interest Calculator Defintion Formula

Balloon Loan Calculator Single Or Multiple Extra Payments

Auto Loan Calculator

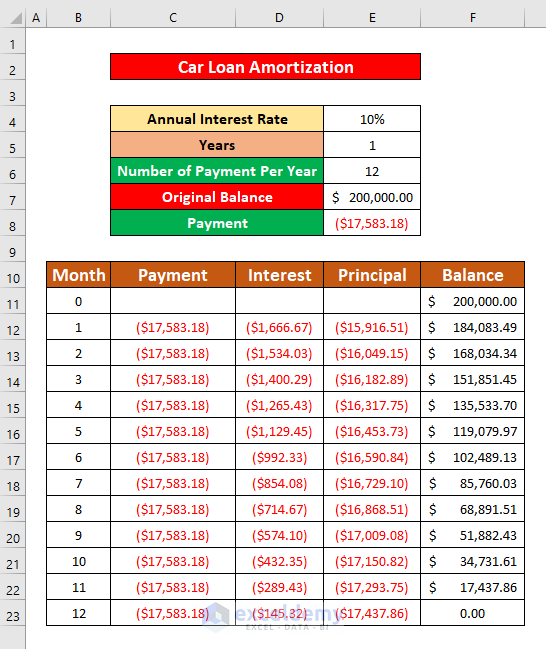

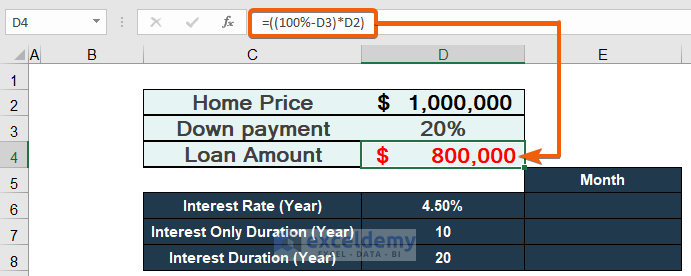

How To Use Formula For Car Loan Amortization In Excel With Quick Steps

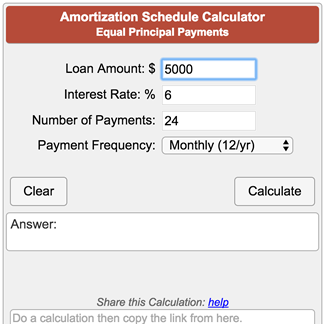

Amortization Schedule Calculator Equal Principal Payments

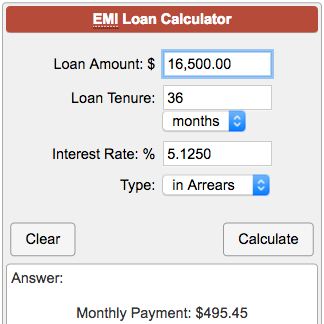

Emi Loan Calculator

72 Month Auto Loan Calculator Investinganswers

Balloon Loan Calculator Single Or Multiple Extra Payments

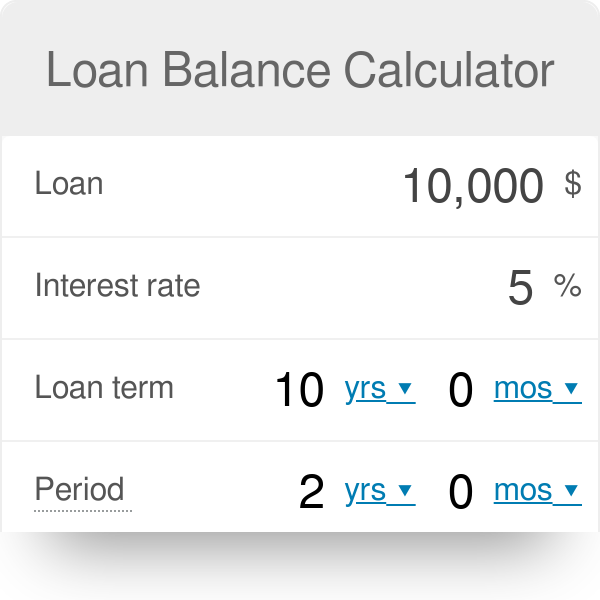

Loan Balance Calculator

Interest Only Mortgage Calculator With Excel Formula A Detailed Analysis

Online Car Payment Calculator Wolfram Alpha

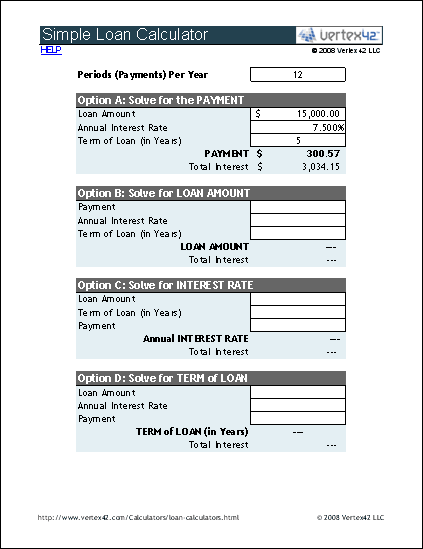

Loan Calculator Free Simple Loan Calculator For Excel

Interest Only Mortgage Calculator With Excel Formula A Detailed Analysis

Simple Loan Calculator

Free Loan Amortization Calculator For Car And Mortgage